Script: How To Get An EIN For The E-2 Visa

Hi this is Ben Frear and today I am going to talk about obtaining an EIN for the E-2 visa.

So, the typical E-2 visa case for an individual investor looks like this…

The investor has an idea for a business in America in which they want to invest. They transfer their personal funds into the bank account that was set up for the business. Then they spend all the money that is needed to launch the business. They buy equipment, they hire professionals, they spend money on marketing. And once they commit this money to the business, they apply for the E-2 visa through a consulate or embassy abroad or they file for a change of status from within the US.

But, the question is how does a foreign national open a bank account for their business?

In order to do that you need to form your entity. So you form your corporation or LLC or whatever business entity is most appropriate for you. Then, you can apply for an EIN.

What Is An Employer Identification Number (EIN)?

An Employer Identification Number (EIN) is a unique identification number that is assigned to a business entity so that it can easily be identified by the Internal Revenue Service (IRS). It is commonly used by employers for the purpose of reporting taxes.

The EIN is also known as a Federal Tax Identification Number. When it is used to identify a corporation for tax purposes, it is commonly referred to as a Tax Identification Number (TIN).

So, you need this number to open the bank account for your E-2 business. How do you get it? You can go to the IRS website to see how to qualify and to see the different ways in which you can apply…

- You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. However, the person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN).

At this point, a lot of foreign national entrepreneurs get stuck. You may not have a SSN or an ITIN, so how do they apply? Here is what you can do…

You can follow the instructions for getting an EIN by fax. This gets you an EIN quickly. Here are the instructions from the IRS on how to do this…

From The IRS Website…

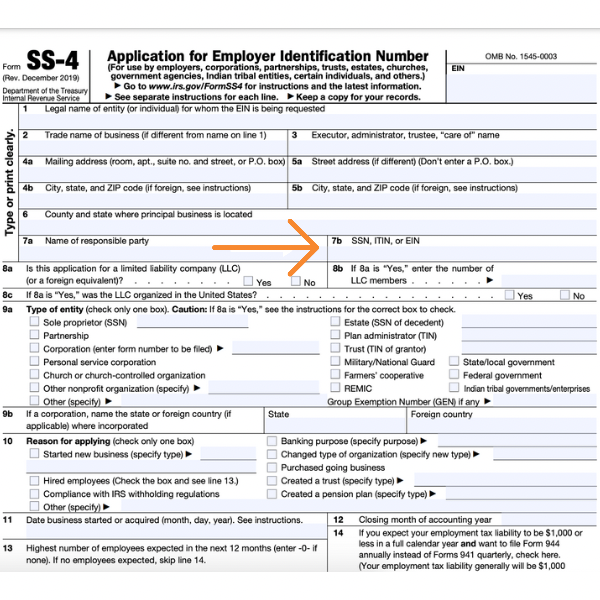

Taxpayers can fax the completed Form SS-4 application to the appropriate fax number (see Where to File Your Taxes (for Form SS-4)), after ensuring that the Form SS-4 contains all of the required information. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type. If the taxpayer’s fax number is provided, a fax will be sent back with the EIN within four (4) business days.

When you pull up the form you will see a question that asks for the SSN or an ITIN.

If you don’t have that number(and you probably won’t) you can simply write something to the effect of “foreign business owner” in the line that asks for the number. Then, once you fax in that form you should get an EIN quickly.

After you have the EIN for your entity, you can open a corporate account, transfer money into that account and start to spend the money on all the things that you need for your E-2 business.

Hopefully this information was helpful!

Also, if you are considering the E-2 visa, make sure to reach out to one of the many amazing immigration lawyers that you can find across the globe to get specific guidance that is tailored to your unique situation.

Thanks for your time and best wishes!

Benjamin Frear, Esq.

Immigration Lawyer For Entrepreneurs